Build Better Credit!

Contact us today to speak with our experts

Why More Americans Are Turning To Credit Cards

Americans today are feeling more financial pressure than ever. In mid-2024, credit card debt reached $1.142 trillion—a record high since 1999. Why is this happening?

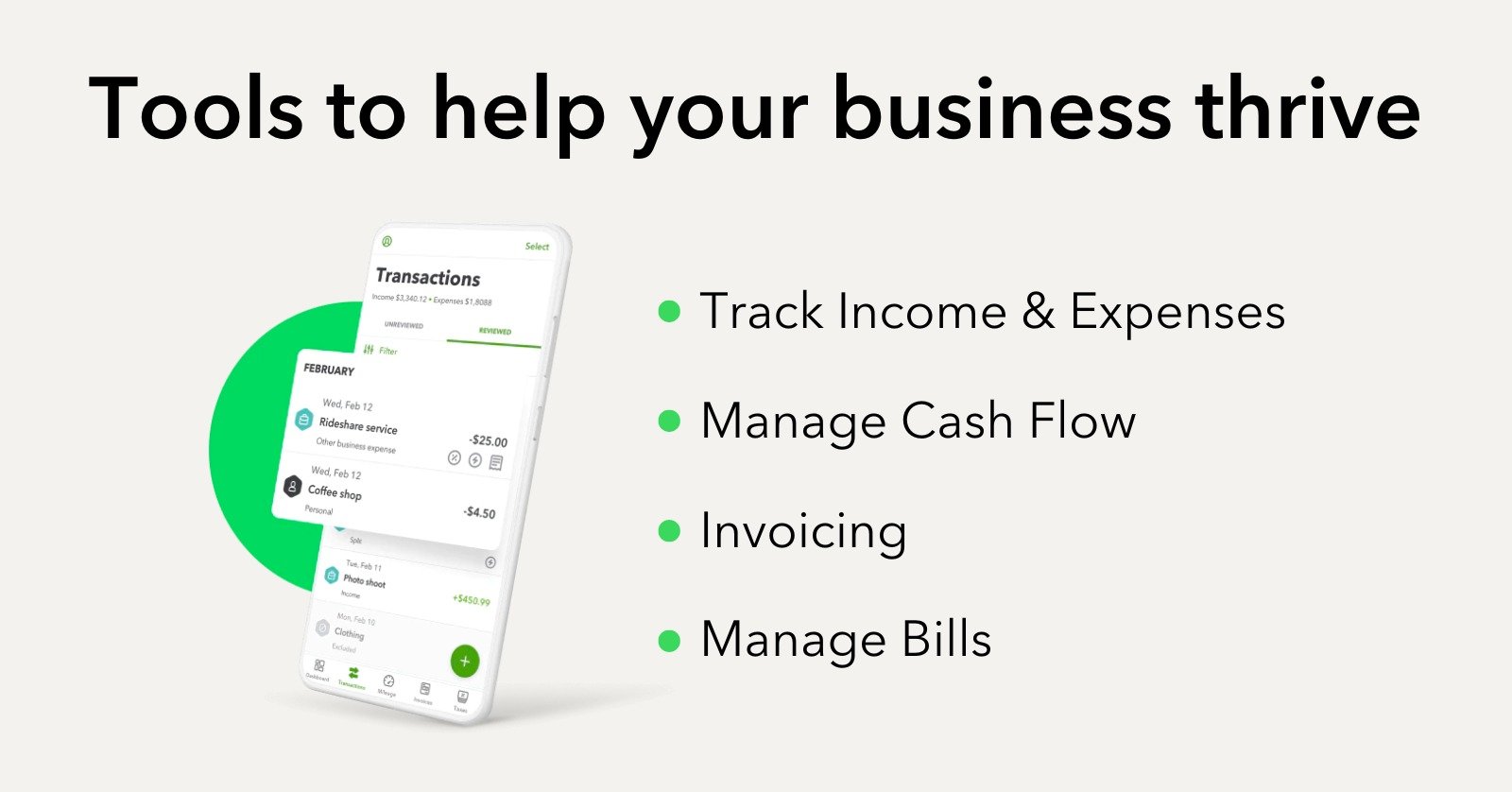

3 Essential QuickBooks Tools to Navigate Tax Season Like a Pro

As Tax Season rolls around, small business owners everywhere begin to feel the pressure of getting their financials in order. It’s a daunting task, but

Protecting Your Amazon Experience: Beware of These 3 Common Impersonation Scams

Introduction: Amazon, the e-commerce superstar that offers nearly everything under the sun, has become a target for scammers. In fact, it’s so popular that scammers

Prehired Exposed: How Student Loan Borrowers Were Misled

“Prehired will void all outstanding income share agreements, refund harmed borrowers, and permanently cease operations” In a recent announcement, the Consumer Financial Protection Bureau (CFPB)

An Overview of the CFPB & State Initiatives to Stop Wrongful Medical Bill Collections

Why this will interest you This is crucial because many consumers have suffered due to incorrect and unverifiable medical bills on their credit profiles. We

Reducing the Impact of Medical Debt on Credit and the Importance of Good Health in Your Financial Journey

Introduction: For those of you who’ve faced expensive medical challenges, the recent actions taken by the Consumer Financial Protection Bureau (CFPB) are a step further

Navigating the Financial Maze: Your Quest to Success with QuickBooks

Did you know that managing your personal finances is a lot like managing your business finances? In today’s rapidly changing world, one thing remains constant:

Unmasking Debt Collection Deception: Your Guide to Spotting Scams and Asserting Your Rights

Welcome to the wild world of debt collection, where phone calls feel like bombardments and letters seem to multiply like rabbits. But fear not, intrepid

SCAMMERS OFFERING TO HELP WITH DISABILITY APPLICATIONS

Scammers are trying to get personal information from people by pretending to help with applications for disability benefits and claims. A recent alert from the

OOH, A SALE! OR IS IT?

You’re scanning the shelves at a local pharmacy, grocery, or convenience store, and your eyes land on a sales tag. At first glance, it looks

71 PERCENT BELIEVE STUDENT DEBT DELAYS HOMEOWNERSHIP, NAR FINDS

Seventy-one percent of non-homeowners repaying their student loans on time believe their debt is stymieing their ability to purchase a home, and slightly over half

5 OUTSIDE-THE-BOX WAYS TO COMBAT WORK STRESS THAT REALLY WORK

Back in the day, unwinding once the clock hit 5 P.M. meant a pow-wow with coworkers at a local watering hole. But as work

CREDIT BUILDER BLUEPRINT®

CREDIT BUILDER BLUEPRINT® What is missing in the credit credit service organization industry? Communication… And not the standard communication concerning an update on a file

A LITTLE ABOUT ME

A strategically minded individual with a keen sense of competitive intelligence and market analysis. Highly experienced in driving sales initiatives to boost sales in order

CREDIT BASICS FOR YOUNG ADULTS!

Educate yourself now and enjoy a more secure financial future. As a young adult, in most cases, the initial step to building credit will be

TOP 5 CAUSES OF EXCESSIVE PERSONAL DEBT

Excessive debt is the biggest worry of most people. Financial issues are one of the leading contributors to divorce and suicide. We are provided with

SEVEN QUESTIONS THAT WILL HELP YOU SNIFF OUT A DEBT COLLECTOR SCAM

A “debt collector” call can arrive at any time for just about anyone. Even if you’ve never missed a payment on a bill. There’s only one

OTHER DEBT SETTLEMENT PROGRAMS

Debt settlement programs typically are offered by for-profit companies and involve them negotiating with your creditors to allow you to pay a “settlement” to resolve

EASY WAYS TO AVOID INTEREST AND PREVENT ENDLESS DEBT

Interest can really wreak havoc on your financial position! It’s so easy to end up in constant debt because of interest applied by your financial

CREDILIFE DEBT MANAGEMENT

Credilife® works to empower consumers to take back their buying power. When it comes to active revolving debt obligations we can help you to put a

YOU WANT STUDENT LOAN FORGIVENESS? DO THIS ASAP!

As if dealing with student loans wasn’t tough enough, now getting them forgiven is a hassle. A new report found that borrowers trying to qualify for forgiveness

THE STUDENT LOAN ZONE

Student loan debt has soared to $1 Trillion in the United States. With the cost of higher education rising every year, student loans are the

STUDENT LOANS 101: WHAT YOU NEED TO KNOW ABOUT REFINANCING YOUR DEBT

Brought to you by First Republic Bank With the price tag on higher education growing steeper every year, it’s become routine for most graduates to

PRIVATE VS. FEDERAL STUDENT LOANS

PRIVATE VS. FEDERAL STUDENT LOA For most families, student loans are a big part of financing a college education. While student loans are quite easy

HOW TO GET STUDENT LOANS FORGIVEN

The college years can be among the most fun years of your life, even with all that hard work and studying, the all-nighters, and the

HERE’S EXACTLY HOW STUDENT LOAN INTEREST WORKS

Back when you signed the dotted line and took out your student loans, how well did you understand the terms? Maybe things were a little

CREATE YOUR FEDERAL STUDENT AID ID

In 2015, FAFSA (Free Application for Federal Student Aid) switched from using a four-digit PIN to a more secure Federal Student Loan (FSA) ID. If you haven’t

5 TIPS TO PAY OFF YOUR STUDENT LOANS IN RECORD TIME

It can be quite difficult for students to put themselves through college because of the costly tuition fees. Most students will take out private or

4 MUST KNOW FACTS ABOUT OBAMA’S NEW STUDENT LOAN PLAN

Student loan borrowers affected by the changes proposed for 2015 should still be research repayment options and choose the plan that best fits their budget.

YOUR 4-WEEK GUIDE TO SETTING (AND STICKING TO) A REALISTIC BUDGET

There are few of us out there who would attempt to build a house without following a blueprint. And for good reason: one poorly placed

WHY HAVING A HIGH CREDIT SCORE DOESN’T ALWAYS MEAN YOU’RE FINANCIALLY HEALTHY

Originally posted by Vickie An at LearnVe$t There are few numbers that can make you feel prouder about your money-management skills than a strong credit score.

WHICH CREDIT CARD SHOULD YOU PAY OFF FIRST?

Whether from some unexpected, big-ticket costs or just a steady lifestyle creep, it’s easy to turn to a credit card (or two, or three) to

WHERE YOU SHOULD REALLY CUT BACK ON YOUR BUDGET

A lot of traditional budgeting advice tends to focus on eliminating the little luxuries in life that can add up over time, like that morning

SAVING FOR COLLEGE VS. RETIREMENT

If you’re a parent, you very likely want to give the world to your children. If money really did grow on trees, you’d be out

MISTAKES TO AVOID WHEN TEACHING YOUR KIDS ABOUT MONEY

Scroll through any parenting site and you’re bound to find lessons on teaching your kids about the A-B-C-s, 1-2-3-s, or maybe even the birds and

GOOD REASONS FOR GOING INTO DEBT

We’re usually led to believe that debt is bad. Carrying a large load of credit card debt is something that just didn’t happen a few

FUN WAYS TO TEACH YOUR KIDS ABOUT EARNING, SPENDING AND SAVING

Of the many lessons we want to teach our kids, money is at the top of the list. It’s an easy one to forget, so

EVERYTHING YOU NEED TO KNOW TO RAISE FINANCIALLY FEARLESS KIDS: 12 WAYS TO INSTILL MONEY CONFIDENCE AT EVERY AGE

Money-minded moms and dads take heart: An H&R Block study revealed that 75% of teens rely on you as their primary source of financial information. That’s promising news—especially given

BUDGETING THE EASY WAY: THE ONE-NUMBER STRATEGY

by Brian Del Terzo for Credilife™ In this article, you will be introduced to the essence of the purpose of a budget. By becoming conscientious of

8 MONEY TIPS FOR YOUNG ADULTS

Personal finance still isn’t required in high school or college. This results in many young adults not having a good foundational knowledge of how to

7 SIGNS YOU’RE HEADED FOR FINANCIAL DISASTER

Many of us are good at ignoring the negative trends in our lives. Maybe we refuse to acknowledge a growing waistline or a relationship that’s

6 COMMON MYTHS ABOUT FINANCIAL PLANNING—BUSTED

In this era of DIY, we’ve grown accustomed to doing professional-level work on our own, whether it’s concocting “Top Chef”–worthy weeknight meals, renovating our homes,

4 EFFECTIVE STRATEGIES TO REGAIN CONTROL OVER YOUR SPENDING

Losing control is an awful feeling. Have you ever felt that way about your spending habits? At first, you had them under control. But, little

3 PERSONAL FINANCE APPS THAT HELP YOU KEEP TRACK OF SPENDING

$5 here, $10 over there, and a fistful of change slapped into the palm of a department store employee. Before you know it, all of

10 WAYS TO SAVE WHEN YOU’RE MAKING MINIMUM WAGE

Is your income too low to use any of the typical money-saving strategies? Here are 10 ideas that take cost-cutting to a whole new level.

STEP 6 – SECURE EVEN MORE FUNDING FOR YOUR BUSINESS

Once you finish your business credit building in step 5 you are exposed to more funding programs in step 6. Many of these funding programs

STEP 5 – BUILD YOUR BUSINESS CREDIT TO $50,000 OR MORE

It only takes a few months to build your initial vendor accounts in step 4 and have them reporting on your business credit report. Once

STEP 4 – START GETTING APPROVED FOR BUSINESS CREDIT

In Step 4 we help you get approved for new credit in your business name that reports to the appropriate business credit reporting agencies. Much

STEP 3 – ACCESS YOUR BUSINESS CREDIT REPORTS

Once you have been approved for business funding, we then help you begin the process of building your business credit in Step 3. The first

STEP 2 – GET APPROVED FOR FUNDING

One of the most important differences between our system and every other business credit building system is the cash money you have access to, and

STEP 1 – BUILD BUSINESS CREDIBILITY

Meet Lending Guidelines Before You Apply Almost all lenders keep their underwriting guidelines secret. As a result, most business owners who apply for financing are

15 WAYS TO GROW YOUR BUSINESS

You probably went out on a limb to create the business you now run. You probably took risks to get where you are. You may have

WHAT OR WHO IS TRANSUNION?

Interesting TransUnion History Most consumers are familiar with TransUnion. But there are a few interesting tidbits that most people don’t know about the company. Here

WHAT OR WHO IS EXPERIAN?

Interesting Experian History Most consumers are familiar with Experian. But there are a few interesting tidbits that most people don’t know about the company. Here

WHAT OR WHO IS EQUIFAX?

Interesting Equifax History Equifax is the oldest and largest credit bureau in existence today. They were originally founded in 1898, 70 years before the creation

SHOPPING FOR THE BEST CREDIT CARD

Although it’s wise to pay off all your credit card debt, it’s also practical to have one or two good credit cards. When you travel

MAKING THE DECISION TO RENT OR BUY

Buying a home is exciting. It’s also one of the most important financial decisions you’ll make. Choosing a mortgage to pay for your new home

HOW DID THAT GET ON MY CREDIT REPORT?

First, there are three basic categories of information included in a credit report. These are: Basic Personal Information: This is pretty self-explanatory. Included in your credit

HOW BIG DEBTS AND BAD CREDIT IMPACT YOUR PHYSICAL AND EMOTIONAL HEALTH

If you are struggling with big debt, you most likely are focusing on the financial consequences of your predicament. According to Credit Sesame’s 2016 proprietary data,

DETERMINING YOUR DOWN PAYMENT

Watch our short video to learn what to consider when choosing how much to put down.

BASIC CREDIT DEFINITIONS WE ALL SHOULD KNOW

Going to grad school. Buying a home to call your own. Landing a dream job. These are major milestones that many of us have on

ANNUAL CREDIT REPORT: SMALL CHANGES MAKE BIG IMPROVEMENTS IN YOUR CREDIT

Your credit report paints a picture of your financial history by detailing your experience with credit cards, loans, and other financial vehicles. Your credit score

9 STEPS TO REMOVING CREDIT REPORT ERRORS

Checking your credit reports on an annual basis can be a great idea. A study done by the Federal Trade Commission found that 25% of

8 TIPS TO IMPROVE YOUR CREDIT SCORE

The first step to improving your credit score is to obtain a current copy of your credit report. Once you have something to work from,

7 CREDIT SCORE DESTROYERS

Your credit score not only determines whether or not you can get a credit card, mortgage, or auto loan, it’s also a critical factor in

6 TIPS THAT WILL HELP YOU BUILD—AND KEEP—GOOD CREDIT6 TIPS THAT WILL HELP YOU BUILD—AND KEEP—GOOD CREDIT

Having “good” credit sounds like something you don’t really need to be concerned with until you’re ready to pony up a down payment on a